AI for Insurance Agents: 7 Strategies To Stay Ahead Of The Game

Artificial Intelligence (AI) is revolutionizing various industries, and the insurance sector is no exception. The advent of AI for insurance has opened up new avenues for agents to maximize their revenues while providing superior customer service.

This blog post will delve into how AI can help you automate your sales and marketing processes, streamline agency management workflows, and leverage data insights effectively.

We will also discuss how AI technology can enhance customer experience by personalizing interactions and simplifying claims handling procedures. Lastly, we’ll shed light on how incorporating AI into your data strategy could speed up accounting workflows in your insurance agency.

Table Of Contents:

- 1. Boost Your Revenues with AI for Insurance Agents

- 2. Automate Your Marketing Processes with AI

- 3. Leverage Insurance AI to Unlock the Power of Data Insights

- 4. Streamline Your Agency Management Workflows with RPA AI

- 5. AI: The Future of Customer Experience in Insurance

- 6. Rev Up Your Insurance Agency’s Accounting with AI

- 7. Leverage Recruiting AI For Insurance Agents

- FAQs in Relation to Ai for Insurance

- Conclusion

1. Boost Your Revenues with AI for Insurance Agents

The insurance industry is transforming with the power of artificial intelligence (AI). As an insurance agent, AI tools can boost your revenues and streamline operations. Let’s explore how.

Automate Prospect Outreach and Communication with AI

AI automates outreach efforts via email marketing campaigns or social media interactions. Tools like Outreach.ai allow you to automate personalized emails based on each prospect’s engagement level or preferences.

Leverage Predictive Analytics for Revenue Growth

Predictive analytics analyzes historical data using sophisticated algorithms to provide valuable insights about future trends or events. This allows agents to make proactive decisions that drive revenue growth.

One great example of this is a prospecting tool called Overloop. It allows you to create automated lead campaigns that target potential customers through cold emails and LinkedIn. It also offers a customizable workflow and data-driven insights about your prospects.

2. Automate Your Marketing Processes with AI

The digital age has revolutionized the way insurance agents conduct business. AI adoption has made marketing processes more efficient and effective. One such tool is Jasper.ai, an AI-powered copywriting assistant that generates high-quality marketing copy for emails, blogs, and video scripts.

Another tool, Lately.ai, allows you to distribute and promote your content effortlessly across various platforms. Lately’s AI engine automatically transforms long-form content into dozens of pre-tested social posts optimized for higher engagement.

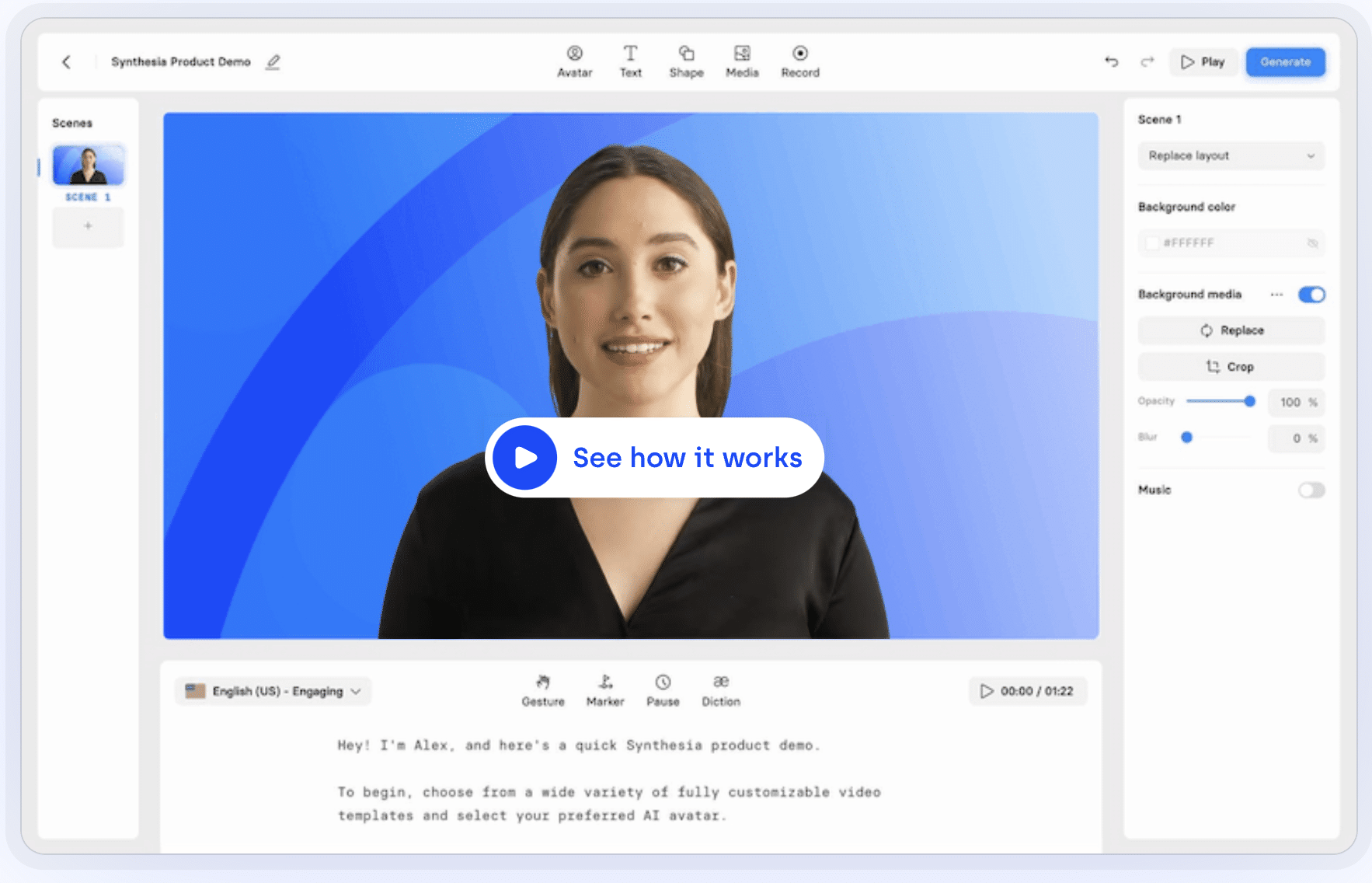

Leveraging Video Content with Synthesia

Want to incorporate videos into your content marketing strategy but lack the resources or skills required? Don’t worry. Synthesia makes it easy for anyone to create professional-looking videos without any prior experience or expensive equipment. Using cutting-edge technology powered by artificial intelligence, Synthesia lets users create original video content quickly using just text input.

Beyond Automation: The Power of Personalization

These tools provide valuable insights into customer behavior patterns, helping agents tailor their messaging accordingly. For instance, if an agent finds out through data analysis that a particular demographic responds better to visual infographics than lengthy blog posts, they could use this information while planning future campaigns, increasing conversion rates.

Tips on Implementing AI in Your Marketing Strategy:

- Analyze & Understand: Thoroughly analyze new tools before implementing them into your workflow process.

- Pilot Testing: Start small when introducing new technologies, conducting pilot tests before fully integrating them into daily operations.

- Data Security & Privacy Concerns: Ensure necessary safeguards are in place to protect sensitive client information.

Put Your Content Marketing On Overdrive

Insurance agents can leverage the power of content to attract more potential customers and grow their business. However, creating high-quality content can be time-consuming and requires considerable effort, resources, and expertise. Fortunately, with the innovative platform provided by Content At Scale, insurance agents can easily create massive amounts of content for their website and drive more inbound leads.

ContentatScale.ai is a cutting-edge solution that uses advanced AI technology to help insurance agents generate customized and engaging content at scale.

Moreover, ContentatScale.ai comes with a series of features that can help insurance agents optimize their website content for search engines, attract more traffic, and convert more leads. The platform provides analytics and insights that enable insurance agents to track the performance of their content and improve their SEO strategy accordingly. By utilizing this data, insurance agents can fine-tune their content to make it more appealing to their target audience and rank higher in search engine results pages.

Here’s a video I made about some of the AI marketing tools insurance agents are starting to use.

3. Leverage Insurance AI to Unlock the Power of Data Insights

Data is power. With AI, agents can harness that power to make informed decisions, improve customer service, and drive growth.

InsuredMine: Analyze Data Effectively

InsuredMine is an AI-driven tool that helps insurance agencies analyze their data effectively. It provides insights into policyholder behavior patterns and preferences to tailor your services to meet client needs better.

Neon For Agents: Streamline Agency Operations

Neon For Agents, by B-Atomic, uses machine learning algorithms to provide real-time analytics on operational efficiency, sales performance, and customer engagement metrics. Identify areas where improvements are needed quickly.

Applied System Analytics: Enhance Decision-Making Capabilities

Applied System Analytics uses advanced predictive modeling techniques to forecast future trends based on historical data from your agency’s operations. Such forecasts enable proactive decision-making that could lead to increased revenue generation.

Leveraging these tools will allow you to predict what might happen next – a crucial advantage in this competitive insurance sector.

Tailor Services Based On Client Behavior Patterns And Preferences:

- Analyze past interactions with clients using InsuredMine or similar tools.

- Determine common characteristics among high-value customers who have shown loyalty over time.

- Create personalized marketing campaigns targeting these specific groups based on learned behaviors and preferences.

Predict Future Trends To Stay Ahead Of The Curve:

- Gather historical operational data from your agency management system.

- Analyze this information using platforms like Applied Systems Analytics.

- Evaluate predicted trends against current strategies – adjust as necessary for optimal results.

Remember, informed decision-making backed by accurate predictions is key to staying ahead of the competition while ensuring sustained growth.

4. Streamline Your Agency Management Workflows with RPA AI

In the insurance industry, repetitive tasks can consume a significant amount of time that could otherwise be spent on more valuable activities. Thankfully, Robotic Process Automation (RPA) and artificial intelligence (AI) technologies are here to help! These advanced technologies have been revolutionizing various sectors, including insurance companies, by automating routine tasks.

RPA AI is essentially software robots or “bots” that mimic human actions. By understanding AI models and machine learning algorithms, these bots can perform complex tasks quickly and accurately without any need for human intervention.

Say Goodbye to Manual Reconciliation with Eleviant

Eleviant, an innovative player in the field of AI for insurance agents, offers solutions designed specifically for insurance agents like you. Their Commission Statement Reconciliation Bot helps automate the direct bill reconciliation process, which traditionally requires hours of manual data entry work by your team.

Eleviant also offers bots that can handle:

- End-to-end policy renewal

- CSR24 account setup

- Renwal transaction automation

- Data cleanup

- And more!

5. AI: The Future of Customer Experience in Insurance

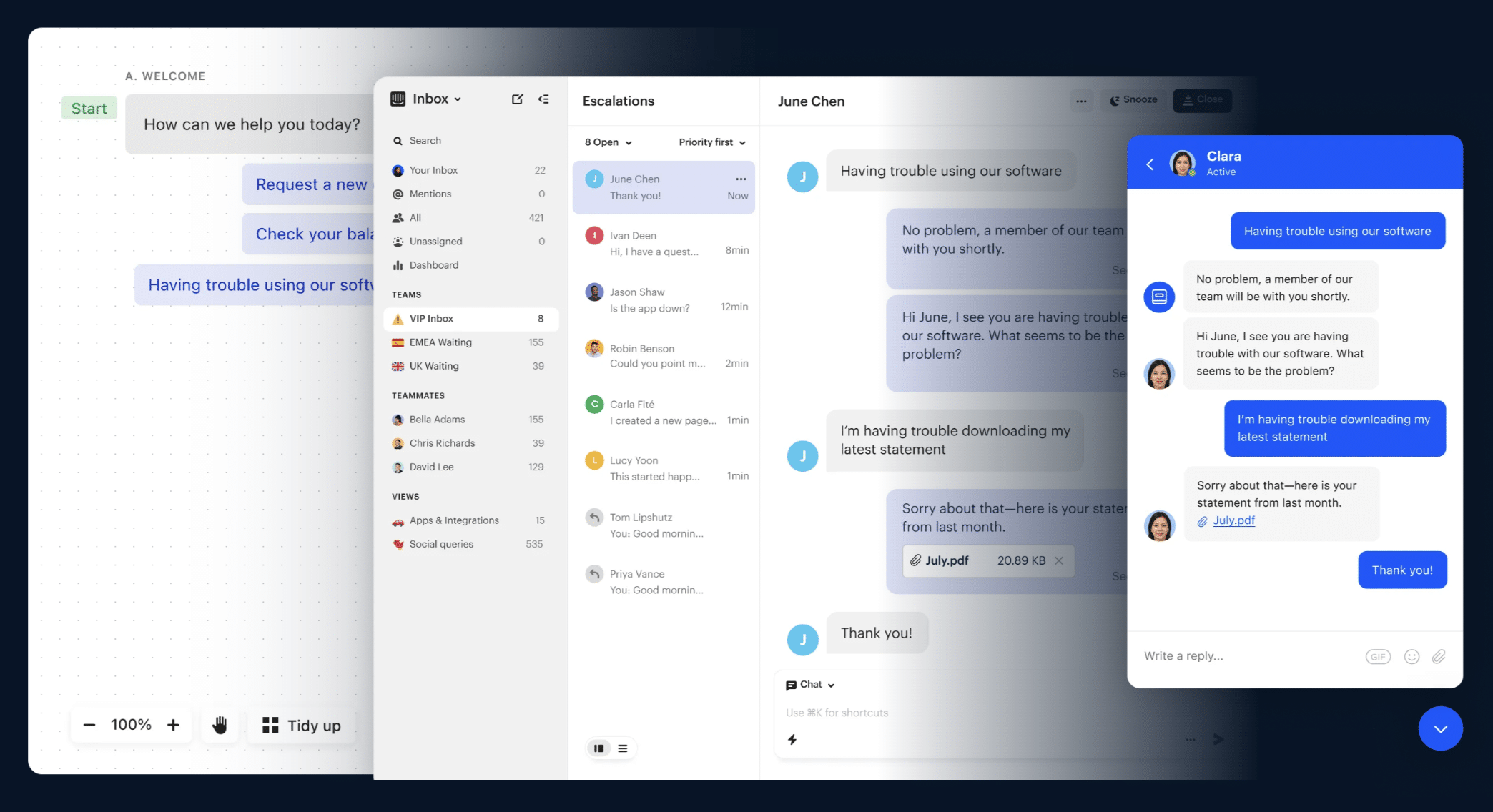

Customer experience is key to any successful insurance agency. AI tools like FreshDesk and LiveAgent can help streamline customer service operations, provide faster responses, and improve overall client satisfaction.

FreshDesk: Efficient Customer Service

FreshDesk is a cloud-based helpdesk solution that uses AI to automate repetitive tasks in your customer service workflow. Its intelligent ticketing system prioritizes queries based on urgency, ensuring critical issues are addressed promptly. The smart knowledge base suggests relevant articles or solutions to customers’ inquiries using machine learning algorithms.

LiveAgent: Chatbot Feature for Communication

LiveAgent’s chat feature uses AI to interact with clients via live chat support. The bot can answer common questions instantly 24/7, freeing up your team’s time for more complex issues requiring human intervention.

Intercom: Swift Client Servicing

Integrating chatbots like Intercom into your website allows for immediate assistance without needing a live agent present. NLP techs are used to interpret and answer questions from customers accurately.

- User-friendly: Intercom provides pre-designed templates making it easy for non-technical users.

- 24/7 availability: Bots are available round-the-clock providing instant responses.

- Data collection: Chatbots gather valuable data from interactions helping agents better understand their customers’ needs.

6. Rev Up Your Insurance Agency’s Accounting with AI

AI isn’t just a buzzword in the insurance industry; it’s a game-changer. One area where AI can make a significant impact is in speeding up accounting workflows for insurance agencies. But how does it work? Let’s explore.

Efficient Receivables Collection and Commission Processing with AI

AI-powered tools can reduce errors, improve efficiency, and speed up critical financial processes like receivables collection and commission processing. These tools use machine learning algorithms to analyze payment behavior patterns and detect anomalies that could indicate potential issues. Automated reminders ensure timely payments from clients while reducing manual follow-up efforts.

Streamline Receivables Collection & Commission Processing with ePayPolicy’s CheckMate Tool

ePayPolicy’s CheckMate tool is an AI-based solution designed specifically for insurance agents. It uses advanced machine learning algorithms to facilitate faster check processing times within your agency. The system scans checks received via email or uploaded manually, extracts relevant data, and updates your management system automatically. This saves valuable time on manual data entry tasks while minimizing the risk of human error.

Additional Benefits of CheckMate

CheckMate not only accelerates check processing times but also reduces errors and simplifies reconciliation. All transaction details are captured accurately at the source level, making reconciliation much simpler.

Incorporating cutting-edge solutions like ePayPolicy’s CheckMate into your workflow not only speeds up crucial financial processes but also enhances overall operational efficiency within your agency. Embracing technology isn’t about replacing humans; it’s about doing our jobs better. As the world progresses technologically, it is essential to utilize AI for insurance if you want to remain a viable agent.

7. Leverage Recruiting AI For Insurance Agents

In the evolving insurance industry, artificial intelligence (AI) is not just a buzzword; it’s an essential tool that enables insurers to evaluate risk more accurately and provide better customer service. One area where AI has proven particularly useful is in recruiting for insurance agents.

Understanding AI tools like RChilli, Fetcher, and HiredScore can help you grow your book of business by finding the best talent out there. These advanced technologies use machine learning algorithms and deep learning techniques to sift through resumes, gauge potential candidates’ skills, experience level, cultural fit, and much more – tasks that would take a human mind hours or even days!

The Power of RChilli in the Recruitment Process

RChilli stands out with its resume parsing feature which uses data analysis to extract valuable information from applicants’ resumes quickly. It turns unstructured data into structured data assets ready for analyzing. This allows you to focus on what really matters: connecting with prospective hires.

Finding Talent with Fetcher’s Machine Learning Algorithms

Fetcher goes beyond traditional keyword search by using predictive analytics based on past hiring patterns to find ideal candidates for open positions within your agency. Its machine learning technology also helps reduce bias during the recruitment process ensuring diversity among hired staff.

HiredScore: The Future of Hiring is Here

HiredScore utilizes conversational AI chatbots as virtual assistants throughout the hiring process providing personalized interaction without requiring constant human intervention – all while keeping track of each applicant’s progress effectively!

FAQs in Relation to Ai for Insurance

How AI is Revolutionizing the Insurance Industry

The transformative power of AI for insurance agents lies in automating processes, enhancing customer experience, and improving decision-making.

- Automating marketing processes and accounting workflows.

- Streamlining agency management workflows.

- Improving risk assessment with predictive analytics.

- Reducing fraud through pattern recognition techniques.

- Enabling personalized policies based on data insights.

- Increasing operational efficiency via automation.

- Enhancing customer interactions through chatbots.

Tools like ePayPolicy’s CheckMate use machine learning algorithms to expedite receivables collection.

While AI may automate some tasks, human touch points will always remain vital, especially when dealing with complex cases requiring professional judgment.

Conclusion

Revolutionize your insurance business with AI solutions that maximize revenues, automate marketing processes, leverage data insights, streamline agency management workflows, enhance customer experience, and speed up accounting workflows.

Stay ahead of competitors and provide better services to customers by embracing the AI trends shaping the insurance industry.

The future of insurance is tied to artificial intelligence as it transforms every aspect of the industry.

All these tools are part of an exciting trend towards leveraging AI technologies in the insurance sector — one that could revolutionize how we recruit new agents and deliver superior customer experiences while lowering costs at the same time! So why wait? Get started today exploring these amazing solutions! Remember though: no matter how sophisticated our tech gets, nothing replaces genuine human connection when building relationships with future team members.